Do payroll choices impact recruitment? | UK Recruitment News

A lean employment market is making for tougher trading conditions for many recruitment firms. As a reversal of this current trend may be some way off, we examine strategies that help agencies make placements.

This week, we consider payroll options – and how recruiters can optimise their own chances, by better understanding the structures and incentives that their clients are offering – or failing to provide – potential hires.

Flexible friends – why more workers want adaptive pay

At first, it may seem a minor consideration. The way a company settles payroll – whether it is once a month, fortnightly, or every week – has little financial impact. After all, the same amount of cash is flowing out of the business each month. So does it really matter when?

According to an increasing portion of British workers, it does. In this blog post, experts from payroll specialists ADP found that payroll flexibility is a growing concern among today’s job applicants. Their survey of 7,000 employers and employees detected an overall awareness of the significance of pay flexibility in hiring.

More than half (58 per cent) of businesses said that they were aware of the need to modernise payment processes to match applicant expectations.

45 per cent said that they knew their outdated payroll structuring was damaging their recruitment prospects.

And the awareness is even greater on the other side of the employment market. In fact, almost two in three job applicants (62 per cent) say that payroll flexibility influences their career choices.

But can recruiters make a difference?

It places recruiters in a challenging situation. It presents one more roadblock for operations. If your clients are not listening and adapting, they could be affecting your ability to make placements.

But it is rarely a recruiter’s place to tell clients how they should run their payroll processes. Perhaps it is best left to the experts to provide the advice. Jeff Phipps, Managing Director of ADP UK had this to say on the report:

“Our research shows that many employers understand and see the need to offer non-traditional payment options and other forms of support.”

“The ability for employers to offer flexibility or off-cycle payments can be a key asset in differentiating a company and competing to attract and retain talent. In the midst of widespread global insecurity and an increasingly competitive war for talent, companies must carefully consider their next steps.”

Not just a question of ‘How’; but also ‘How Much?’

While the payroll experts suggest that businesses are slow to adopt new trends in payment structures, There are other areas where enterprise is keen to match staffing demands.

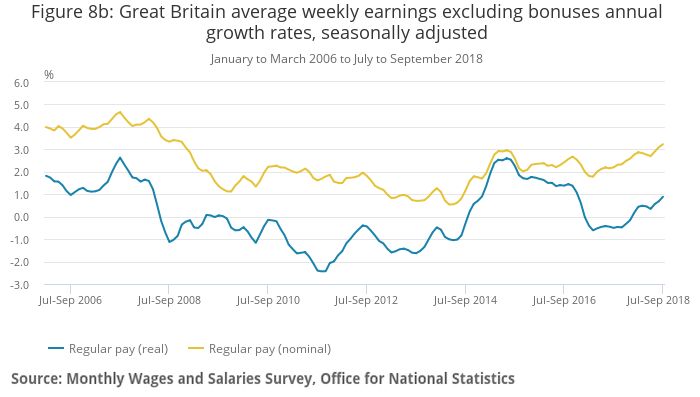

Recent ONS data has found a steady rise in UK wages, as firms strive to retain key staff.

Government data for June to August 2019 shows that Britons are enjoying the longest period of sustained wage growth this century.

Wages for employees have grown 19 per cent in the last twelve months – when calculated to include bonuses. Without bonus payments, earnings rose by a slightly faster rate: 2 per cent. Both sets of figures are adjusted for inflation.

It means that average weekly pay in the UK stands at £509 in nominal terms. This equates to £472 per week when normalised to 2015 prices. This almost matches the pre-credit crunch salary peak of £473 per week, enjoyed in April 2008.

The data forms part of the Office for National Statistics’ monthly jobs market report.